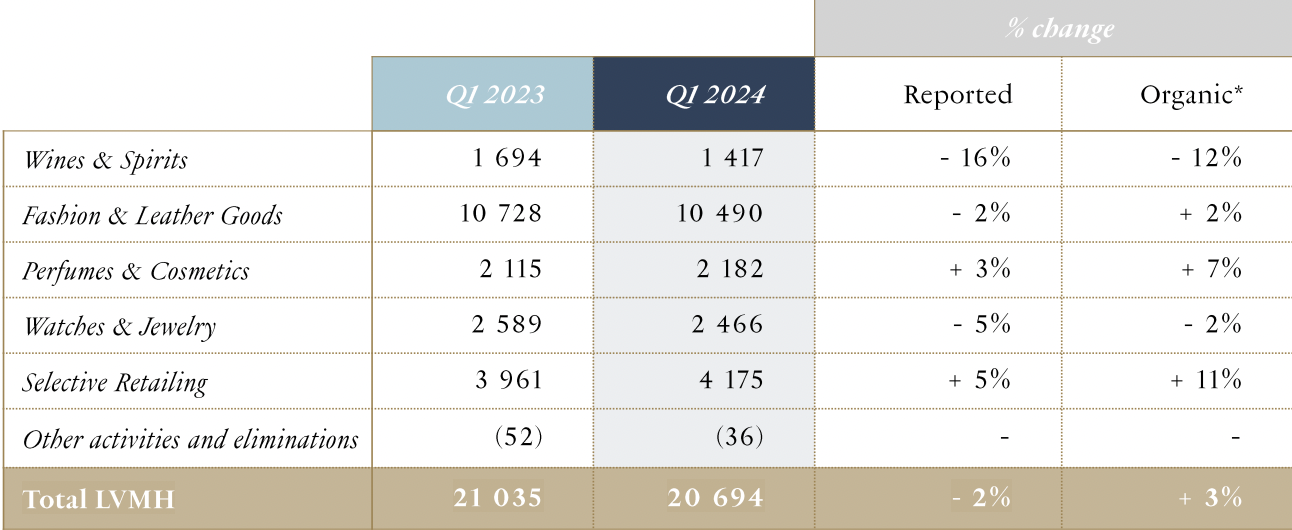

INTERNATIONAL. Leading luxury goods group LVMH Moët Hennessy Louis Vuitton posted revenue of €20.7 billion in the first quarter of 2024, with reported revenue down by -2% and organic growth of +3%.

The company stated: “LVMH had a good start to the year despite a geopolitical and economic environment that remains uncertain. Europe and the United States achieved growth on a constant currency and consolidation scope basis over the quarter; Japan recorded double-digit revenue growth; the rest of Asia reflected the strong growth in spending by Chinese customers in Europe and Japan.”

The Selective Retailing division, which includes DFS Group, posted +11% organic revenue growth (+5% reported) year-on-year. LVMH noted: “DFS remained below its 2019 pre-Covid level of business activity, with international travel only partially recovering in Europe and at flagship destinations Hong Kong and Macau.”

The group highlighted a strong DFS performance in Okinawa and at US airports. It also highlighted the ambitious Yalong Bay project in Sanya, Hainan which is scheduled for opening in 2026.

The Wines & Spirits business group saw a -12% organic revenue decline (-16% reported) in the first quarter. Champagne sales were down, reflecting the ‘normalisation’ of post-Covid demand. Hennessy Cognac was “hampered by a cautious attitude among retailers, which limited their orders in an environment that remained uncertain in the United States”, said LVMH.

The Fashion & Leather Goods business group achieved organic revenue growth of +2% (-2% reported) in the period. Louis Vuitton made an “excellent start to the year” while Christian Dior continued to show “remarkable creative momentum” in all its products. Loro Piana achieved strong momentum while Rimowa and Berluti experienced a good start to the year.

The Perfumes & Cosmetics business group achieved organic revenue growth of +7% (+3% reported), led by Christian Dior in fragrance while the relaunch of Rouge Dior in makeup and the Capture skincare line also contributed. Guerlain was buoyed by robust demand for its Aqua Allegoria fragrances, including its new Florabloom version, as well as its new Abeille Royale creams and Terracotta in makeup.

The Watches & Jewelry business group was down slightly (-2% organic, -5% reported) in the first quarter. In jewellery, Tiffany & Co. continued the global rollout of its new store concept inspired by The Landmark in New York. Bulgari continued to showcase its Serpenti line and relaunched its B.zero1 collection. “Creative momentum remained strong in watchmaking”, with innovations by TAG Heuer, Hublot and Zenith presented in Miami at the fifth LVMH Watch Week.

Dermot Davitt